Frugality & Freedom

In my first blog post I want to explore the intersection of frugality and freedom, and how these concepts have shaped my personal journey towards financial independence. My thoughts are deeply influenced by the book Early Retirement Extreme by Jacob Lund Fisker, who is also the author of a blog by the same name. Fisker is one of the early voices in the FIRE movement “Financial Independence, Retire Early” and his ideas have resonated with me on a profound level.

Money as a Tool for Freedom

Fisker’s philosophy revolves around the idea that money is not an end in itself but a means to an end. He views frugality as a pathway to freedom, a concept that aligns closely with my own beliefs. In my view, money is what enables you to be free. You can achieve freedom in two ways: either by completely disengaging from money, as a monk might, or by using money as a tool to live comfortably within society.

While the monastic path offers a form of freedom, it also comes with its own set of restrictions. You are free from worldly concerns but bound by the rules and routines of monastic life. For me, money is the more practical path to freedom. It allows you to live comfortably without sacrificing your autonomy and surrendering to some sort of strict beliefe-system. The whole “internet atheist“ stereotype is played out, so I’ll say no more.

THE INVESTOR introduces the concept of money as “stored life energy”, and Fiskers arguments are very similar in nature. Every dollar represents the time and effort you’ve exchanged to earn it. Spending mindfully, therefore, means choosing how much of your life you’re willing to trade for material goods. This idea has amplified my belifies in that my approach to spending and saving is valid.

My Personal Experience with Frugality

As a software engineer I’ve been fortunate to earn a salary well above the median in Sweden. This has allowed me to work efficiently, often just a few hours a month, to cover my living expenses. My frugal lifestyle ”owning a modest home, driving a practical car, and living within my means” has given me a significant amount of freedom.

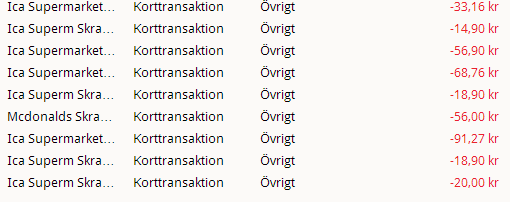

☝️ This is my card-statement from ~2016. Shopping for snacks and drinks. As you can see, this sense of frugality has not always been preset. Nor is it anywhere near perfect even to this day.

I’ve always valued freedom above all else. For me, it’s about being able to do what I want, when I want (within reason). This doesn’t mean indulging in every expensive thought, but having the flexibility to make choices that align with my values and goals.

For example, I recently transitioned from full-time work to part-time consulting while pursuing my studies. This shift hasn’t significantly impacted my financial situation, partaily thanks to Sweden’s generous welfare system, and my part-time earnings. My savings from the full-time job continue to grow through investments, bringing me closer to “financial independence”.

“Escaping the Consumerist Trap“

One of the key lessons I’ve learned from Fisker is the importance of escaping the consumerist trap. In a society that often encourages us to “keep up with the Joneses“, it’s easy to fall into the cycle of constant consumption. However, I’ve found that true freedom comes from living below your means and focusing on what truly matters.

When my partner and I bought our apartment, we had the option to take out a much larger loan. Instead, we chose a modest amount, which has proven to be a blessing as interest rates have risen and property values have fluctuated. This decision has allowed us to maintain our financial stability while pursuing our academic goals.

The Future: Balancing Freedom and Financial Security

Looking ahead, my goal is to continue balancing financial security with the desire for freedom. We plan to buy a house in the future, but only if it doesn’t significantly increase our living expenses. By keeping our costs low, we can maintain our freedom and focus on what truly matters to us.

I’ve also come to realize that my need for freedom is deeply rooted. While some people can commit to long-term projects or careers without feeling constrained, I find that I need the flexibility to pursue my passions on my own terms. This has led me to prioritize financial independence as a way to reclaim my time and live life on my own terms.

Conclusion

Frugality has had a great positive impact on my life and the lives of those around me. By living below my means, I’ve been able to offer some support to others when needed and enjoy a sense of financial security that allows me to focus on what truly matters. In the end, the goal is not to accumulate wealth for its own sake but to use money as a tool to reclaim your time and live a life of freedom. By optimizing your spending and income, you can design a life that prioritizes freedom over consumption, and that, to me, is the ultimate form of success.